Things you should ask before you buy

Times are changing. Fifty years ago, long-term care insurance wasn’t even really thought of. For one thing, few people lived past their late 60’s and so long-term care wasn’t as much the norm as it is today. The second thing is that extended families tended to stay closer geographically and so taking care of senior parents was both possible and expected.

The first thing that you need to determine is whether you will even need long-term insurance.

If you know that you will have an adequate income stream for the rest of your life that will cover the costs of nursing homes and personal care, you might not need insurance coverage. The first rule of insurance is that you only insure what you cannot afford to pay for in one lump sum.

If longevity is in your family and you expect to do the same, you may be more likely to need long-term care insurance than if your family seldom makes it past their early 70’s or you know yourself to be in poor health.

Always check with your employer to see if they have a plan. Because these policies are written in large numbers, you have the benefit of being able to take advantage of superior buying power. What you want to make sure of is that you don’t lose the right to this policy if and when you leave your job for another one.

Some employers even kick in on the costs of long-term insurance. This hasn’t always been this way but employers are now starting to understand that employees are more interested in long-term security than they used to be.

If your relatives routinely live into their 90s and you expect to do likewise, you may be even more likely to eventually need long-term care. If you decide to shop for long-term care insurance, find out first if your employer offers a plan. Often such policies are available at rates lower than you could find on your own.

No matter who you buy the insurance policy from, be sure that you read it carefully before you commit to anything. Be sure that you understand all the conditions, exclusions, how much you will pay, and what if any is the potential for losing your coverage.

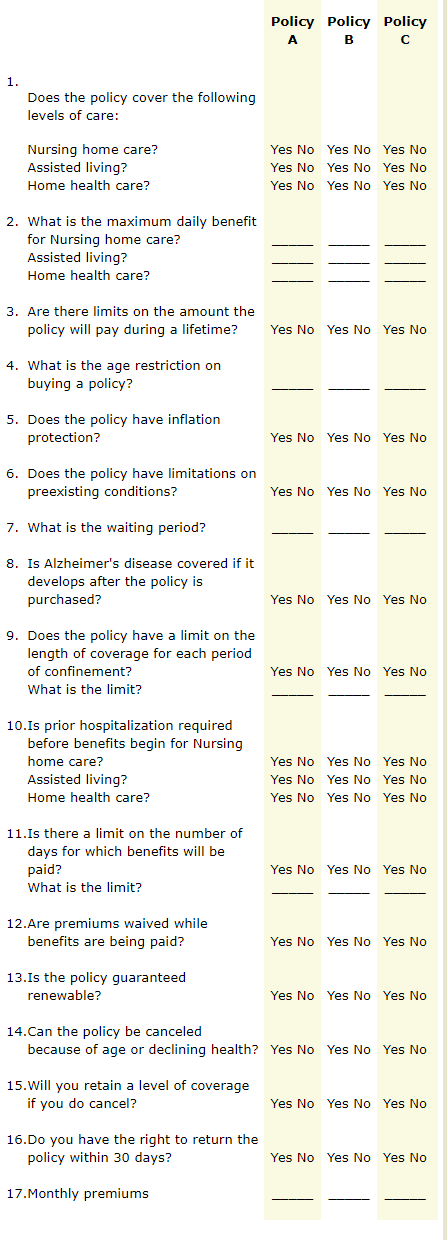

Compare different policies using the questions below. There is no definite right or wrong but balance these in light of what you know you will need for your circumstances.